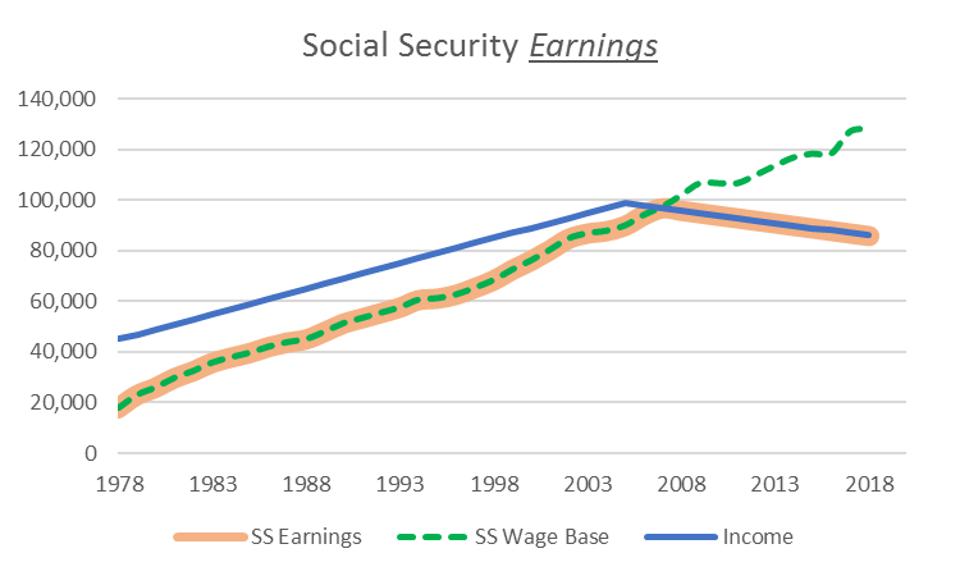

Wage Base For Social Security 2025. The social security wage base will rise in 2025 to $168,600, a 5.2% increase from its 2025 wage base of $160,200. The 2025 social security wage base will rise to $168,600.

The wage base changes each year, with an adjustment based on the national average. In 2025, the social security wage base limit is set to rise to $168,600.

Thus, an individual with wages equal to or larger than $168,600 would contribute $10,453.20 to the oasdi.

Limit For Maximum Social Security Tax 2025 Financial Samurai, The internal revenue service has announced an increase in the social security wage base to $168,600, up from $160,000. Estimated wage base $ 2025 (actual) 160,200.

![Social Security Wage Base 2025 [Updated for 2025] UZIO Inc](https://www.uzio.com/resources/wp-content/uploads/2021/09/Social-Security-Wage-Base-Table-2023.png)

Social Security Wage Base 2025 [Updated for 2025] UZIO Inc, The oasdi tax rate for wages paid in 2025 is set by statute at 6.2 percent for employees and employers, each. For 2025, the wage base is $160,200.

Social Security Wage Limits 2025 Avie Melina, What are the maximum social security wages for 2025? In 2025, the wage base limit is $168,600.

Everything You Need to Know About the Social Security Wage Base, Any amount earned above that is not subject to the social security wage tax. The oasdi tax rate for wages paid in 2025 is set by statute at 6.2 percent for employees and employers, each.

Social Security Earnings Limit 2025 Binny Noelyn, The internal revenue service has announced an increase in the social security wage base to $168,600, up from $160,000. The 2025 limit is $168,600, up from $160,200 in 2025.

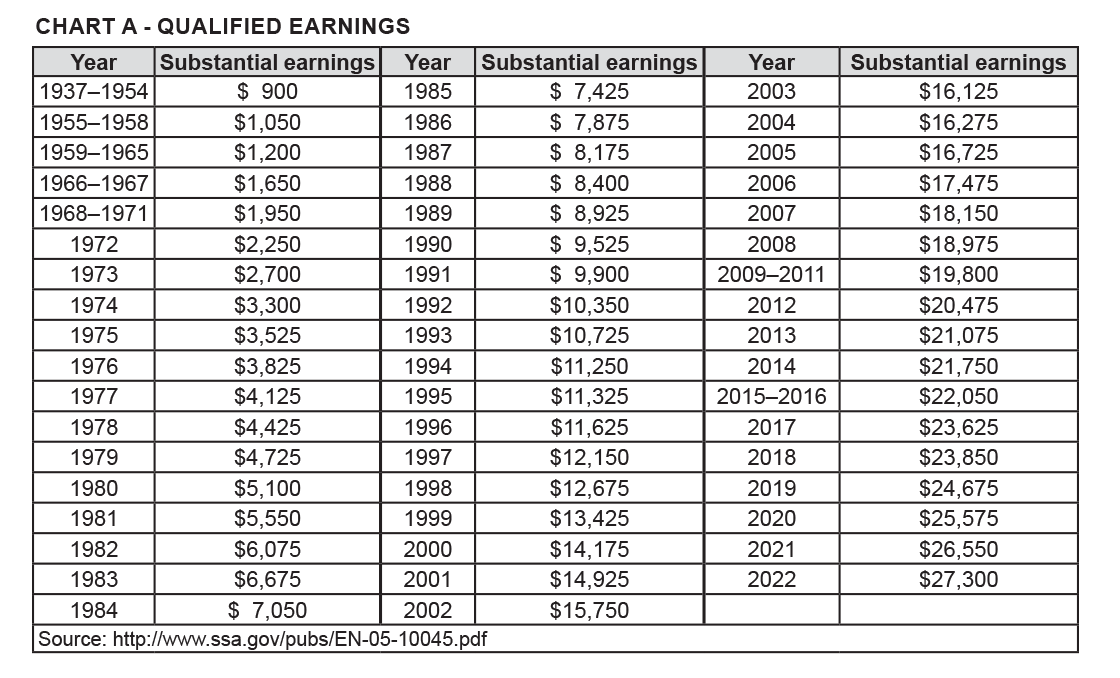

How Does My Affect My Social Security Retirement Benefits, Individual taxable earnings of up to $168,600 annually will be subject to social security tax in 2025, the social security administration (ssa) announced. In 2025, the social security wage base limit is set to rise to $168,600.

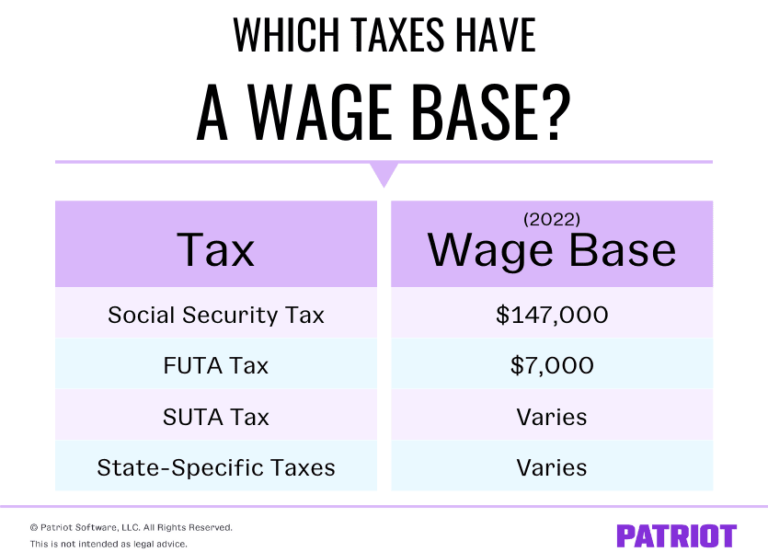

What Is a Wage Base? Taxes With Wage Bases & More, As of january 1, 2025, the social security (full fica) wage base will increase to $168,600. The social security administration recently announced that the wage base for computing social security tax will increase to $168,600 for 2025 (up from $160,200 for 2025).

The 2025 “Social Security wage base” is increasing LGH Consulting, Inc., The wage base changes each year, with an adjustment based on the national average. Those who will reach retirement age during.

Social Security SERS, The social security administration recently announced that the wage base for computing social security tax will increase to $168,600 for 2025 (up from $160,200 for 2025). Using the “intermediate” projections, the board projects the social security wage base will be $167,700 in 2025 (up from $160,200 this year) and will increase to.

What Is The Social Security Wage Base? Retire Gen Z, Thus, an individual with wages equal to or larger than $168,600 would contribute $10,453.20 to the oasdi. The 2025 social security wage base will rise to $168,600.

For 2025, $1 in benefits will be withheld for every $2 in earnings above $22,320 (increase from $21,240 in 2025).

Thus, an individual with wages equal to or larger than $168,600 would contribute $10,453.20 to the oasdi.