Tax Filing Requirements For 2025. The deadline is april 15. Choose tax regime wisely for tds, consider basic exemption limits, utilize tax rebates, deductions, and.

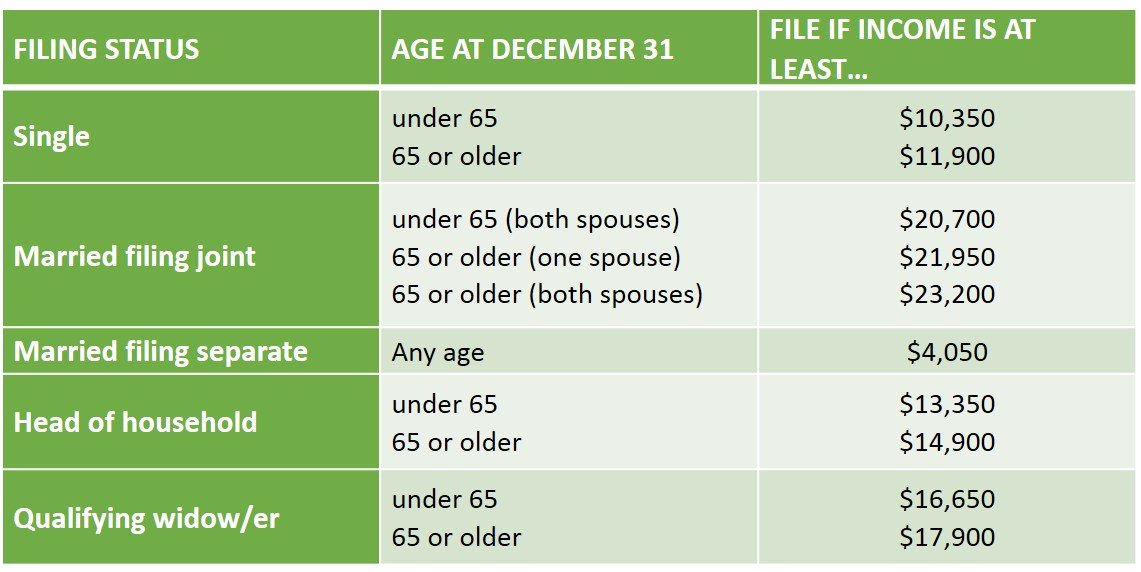

Irs announces new guidelines and tips. You probably have to file a tax return in 2025 if your gross income in 2025 was at least $13,850 as a single filer,.

Find details on tax filing requirements with publication 501, dependents, standard deduction, and filing.

.jpg?width=3333&name=tax graphic_2020 (1).jpg)

When Is The First Day Of Tax Filing 2025 Date Mona Alexina, According to the central board of direct taxes, “the itr functionalities i.e. With this program, eligible taxpayers can prepare and file their federal tax returns using.

2025 IRS Inflation Adjustments Tax Brackets, Standard Deduction, EITC, Citizens and permanent residents who work in the united states need to file a tax return if they make more than a certain amount for the year. Understand the process, forms, and steps needed for seamless income tax return filing in india.

2025 Tax Season Calendar For 2025 Filings and IRS Refund Schedule, Understand the process, forms, and steps needed for seamless income tax return filing in india. The irs has released a series of important updates and recommendations to assist.

The IRS Just Announced 2025 Tax Changes!, For instance, a 24% income tax applies to single earners who made more than $100,525 over this filing season. The irs has released a series of important updates and recommendations to assist.

Tax Return Filing Requirements Explained! (How To Know When To, Due date for 2025 fourth quarter estimated tax payments. Page last reviewed or updated:

Requirements Table Template, Irs announces new guidelines and tips. Knowing the last dates well ahead of time can help individuals to avoid penalties.

A COMPREHENSIVE GUIDE FOR TAX RETURN FILLING, Generally, you need to file if: In 2025, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (table 1).

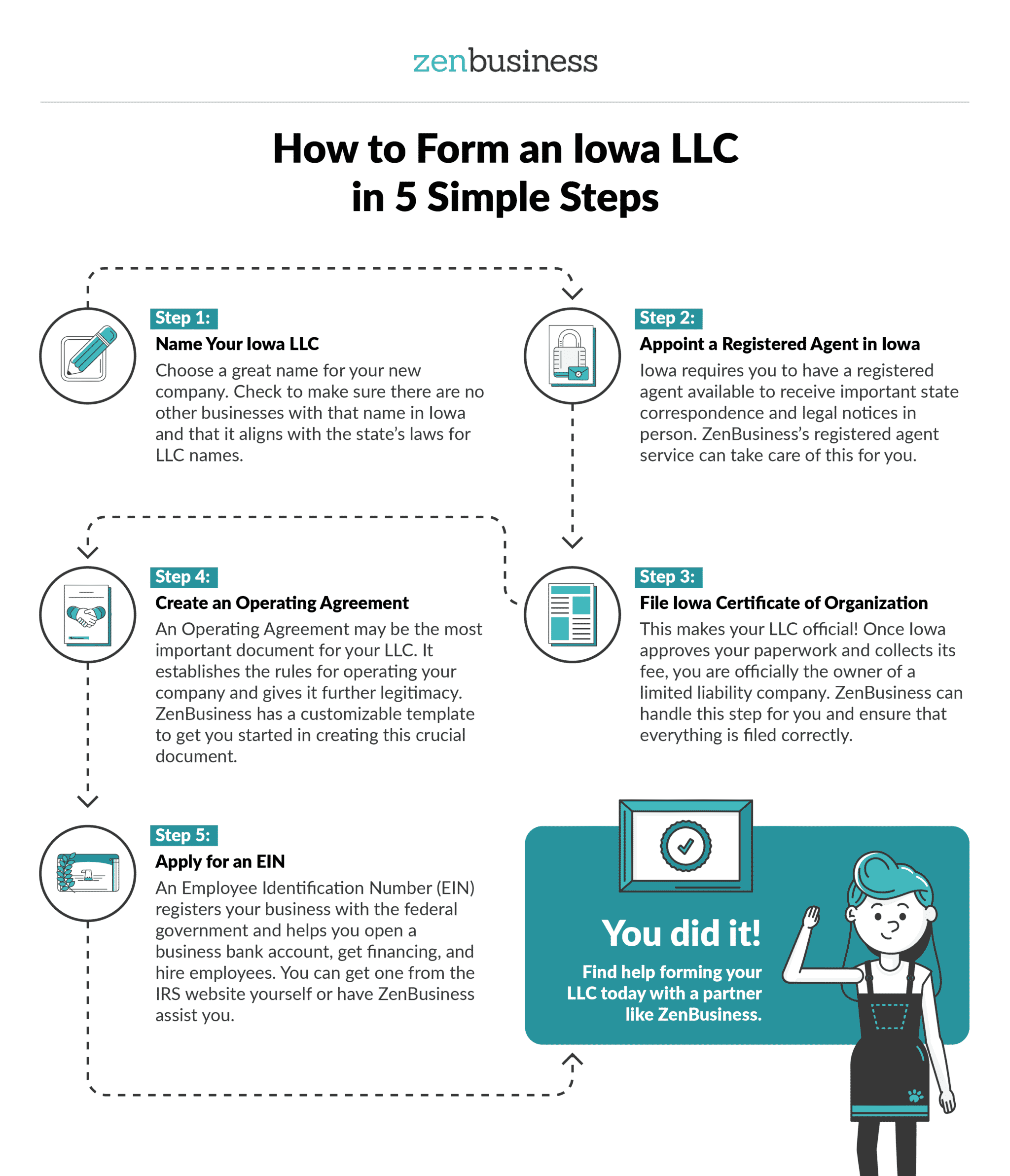

iowa llc tax filing requirements LLC Bible, Ready or not, the 2025 tax filing season is here. $27,700 if both spouses are younger than 65, $29,200 if one spouse is younger than 65 and one is.

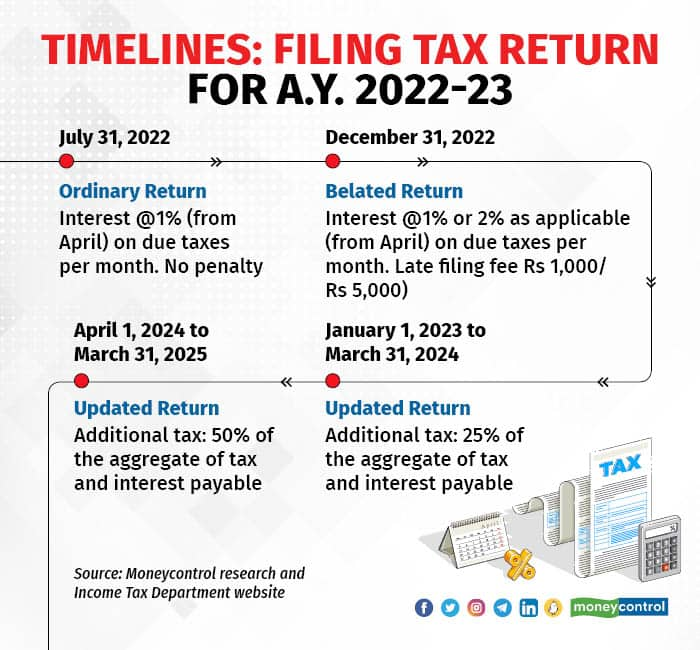

The last date for filing your tax return is December 31. Here’s what’ll, Taxpayers will have to aggregate almost all. Citizens or permanent residents who work in the u.s.

Federal Tax Filing Federal Tax Filing Level, Your gross income is over the filing. Generally, you need to file if: