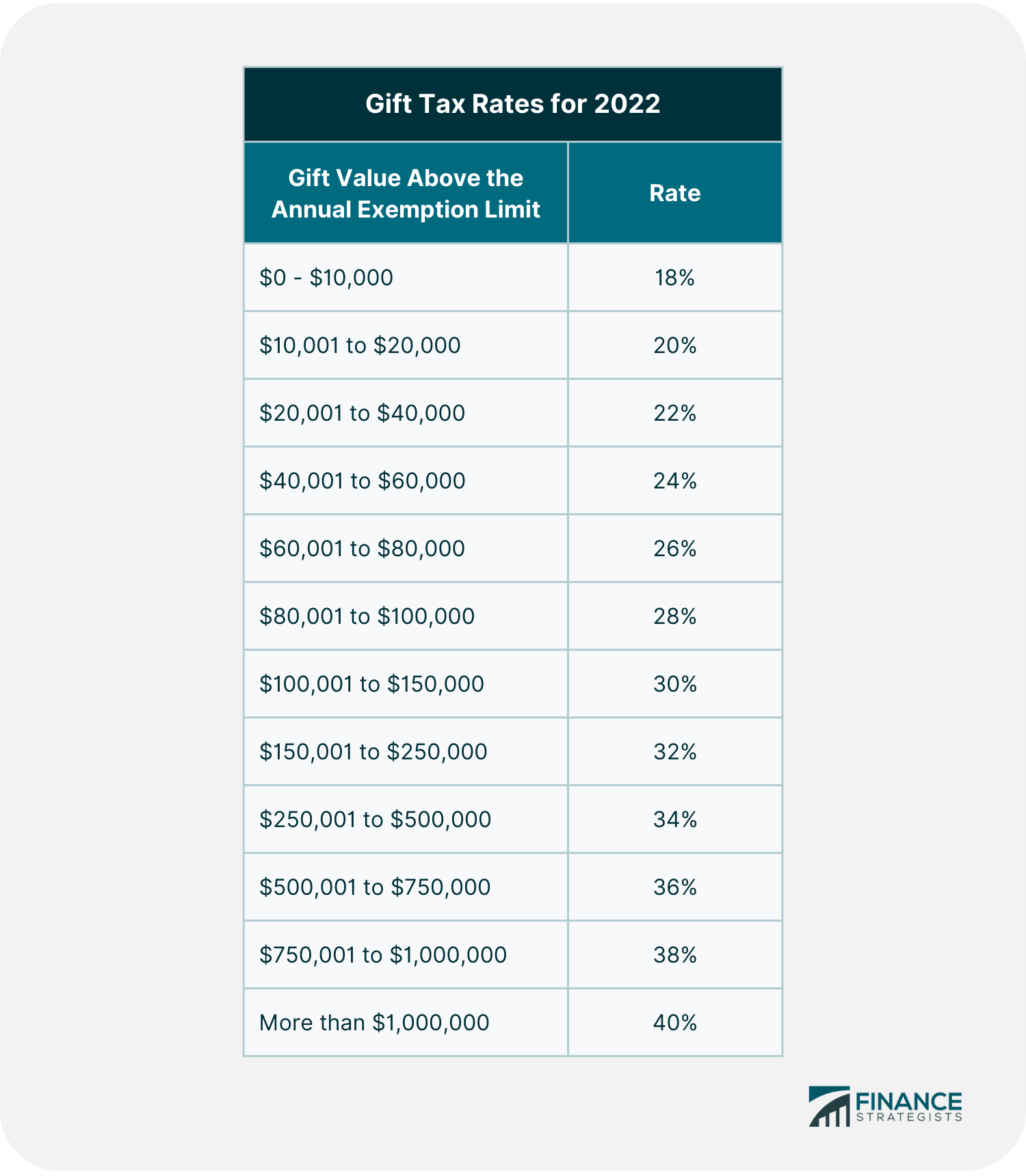

Gift Amount To Children Limit 2025. For married couples, the limit is $18,000 each, for a total of $36,000. This amount is the maximum you can give a.

For example, a man could give $18,000. This means that you can give up to $13.61 million in gifts throughout your life without.

What Is The Limit On Gift Tax For 2025 Rory Walliw, What is the gift tax limit for 2025? For instance, if a father makes a gift of $118,000 to his daughter this year, that transfer creates a potentially taxable gift of $100,000 ($118,000 minus the $18,000 annual.

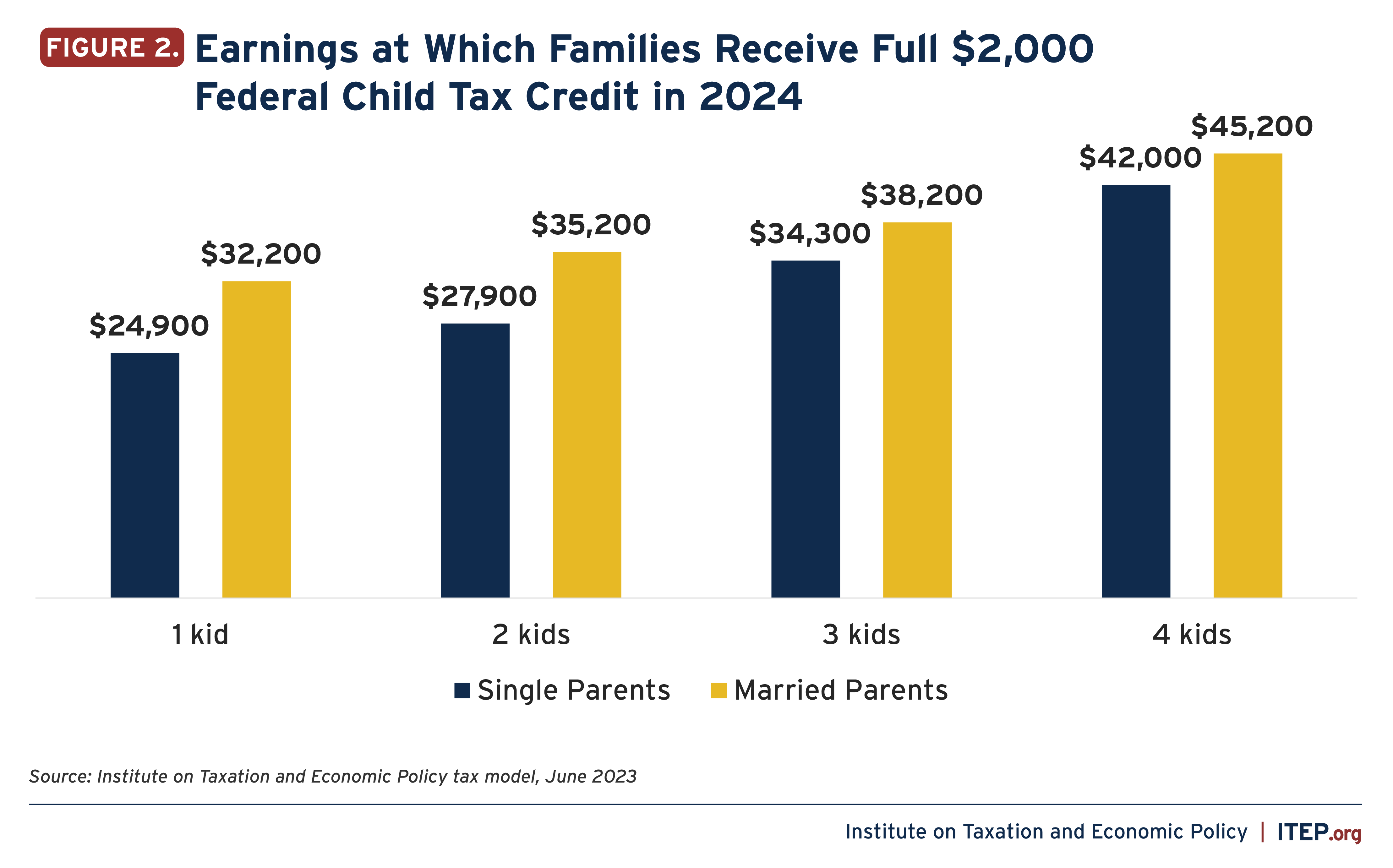

Ctc Limits 2025 Gabbey Emmalee, In 2025, that limit rises to $18,000. The irs typically adjusts this gift tax exclusion each year based on inflation.

Gift Limit 2025 Per Person Kally Marinna, This amount is the maximum you can give a. In 2025, you can make annual gifts to any one person up to a maximum of $17,000 per year ($18,000 in 2025, estimated to be.

IRS Gift Limit 2025 All you need to know about Gift Limit for Spouse, This means you can give up to $18,000 to as many people as you want in 2025 without any of it. 2 you’ll have to report any gifts you give above that.

Gift Tax Amount 2025 Hayley Auberta, This is known as the annual gift tax exclusion. This amount is pivotal because it determines how much can be gifted to each minor.

Texas Medicaid Guidelines 2025 Kayle Melanie, For 2025, the annual gift tax limit is $18,000. For the tax year 2025, an individual can give up to $17,000 per person without informing uncle sam.

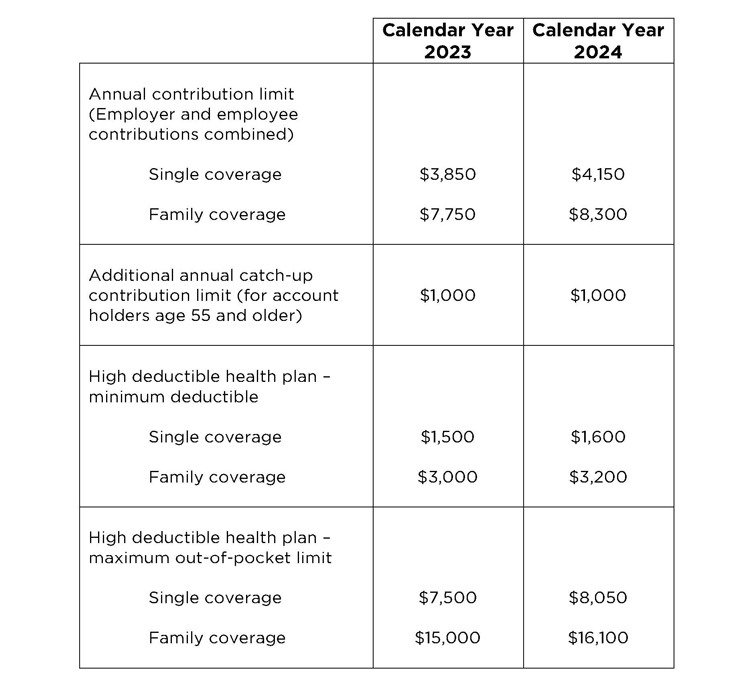

Hsa Contribution Limits In 2025 Tanya Eulalie, Tax laws concerning gifts to children are currently structured in a way that allows parents to give a certain amount of money or assets to their children each year without incurring any gift tax. How do estate and gift taxes actually work?

What'S The Max Social Security Tax For 2025 Carin Cosetta, The 2025 gift tax limit is $18,000, up from $17,000 in 2025. Tax laws concerning gifts to children are currently structured in a way that allows parents to give a certain amount of money or assets to their children each year without incurring any gift tax.

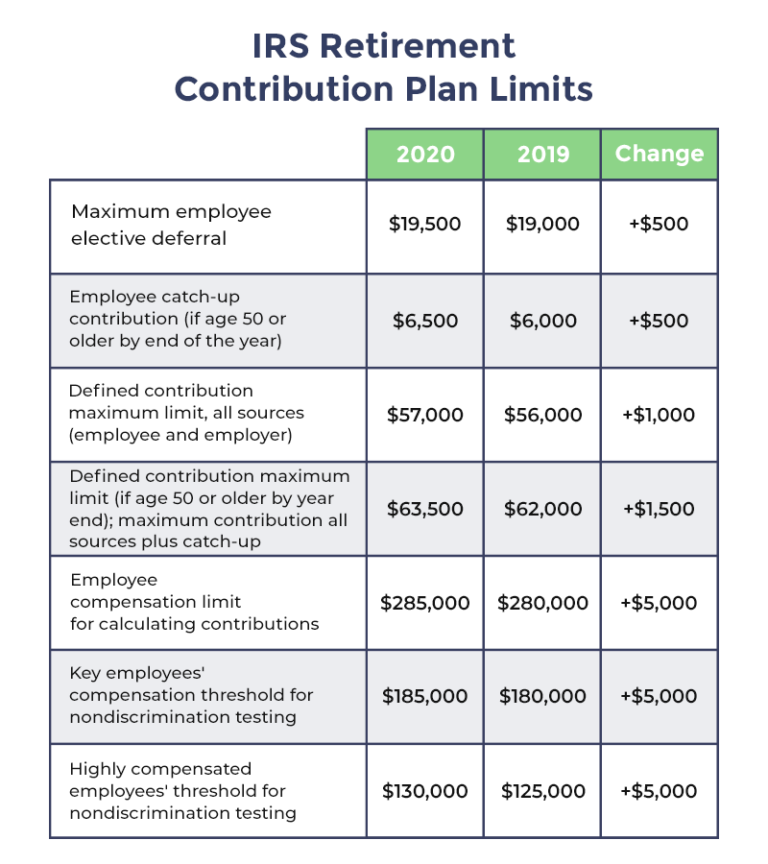

401k 2025 Contribution Limit Chart Over 50 Eden Nessie, For 2025, the annual gift tax limit is $18,000. For 2025, the annual gift tax exclusion is $18,000, up from $17,000 in 2025.

3600 Child Tax Credit 2025, Eligibility Criteria, Benefits, Required, For example, a man could give $18,000. For married couples, the limit is $18,000 each, for a total of $36,000.