2025 Payroll Deduction Calculator. Bankrate.com provides a free payroll deductions calculator and other paycheck tax calculators to help consumers determine the change in take home pay with different. However, the 6.2% that you pay only applies to income up to the social security tax cap, which for 2025 is $160,200 ($168,600 for 2025).

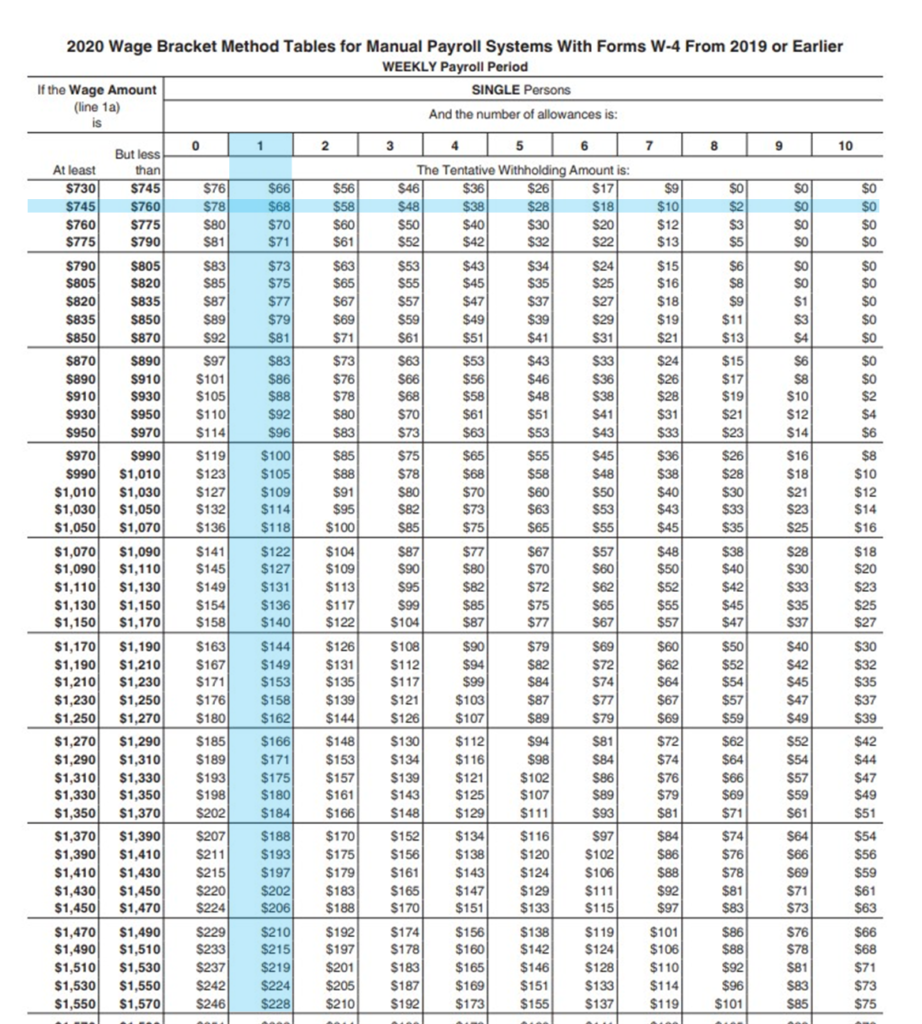

How to calculate payroll deductions for employee (simple scenario), To calculate an annual salary, multiply the gross pay (before tax deductions) by the number of pay periods per year. So any income you earn above that cap.

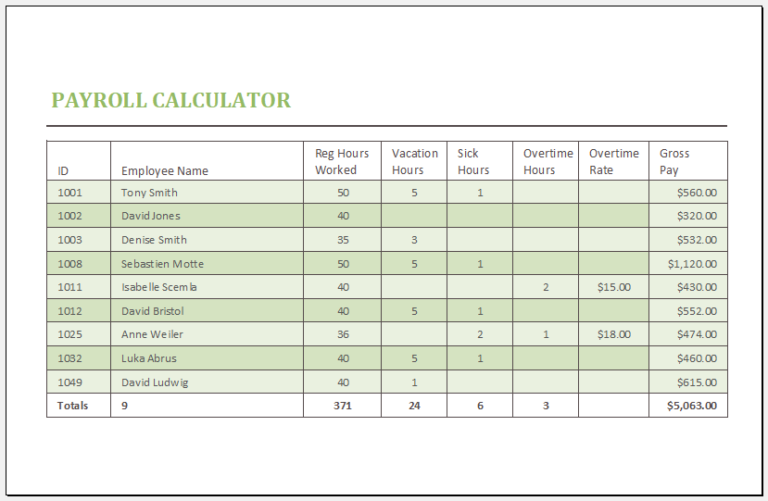

Payroll Calculator Template for MS Excel Excel Templates, Paycheck manager's free payroll calculator offers online payroll tax deduction calculation, federal income tax withheld, pay stubs, and more. The salary calculator has been updated with the latest tax rates which take effect from april 2025.

2025 Bracket Matrix Calculator Helge Brigida, 2025 federal/state income tax, fica, state payroll tax, federal/state standard deduction,. A payroll calculator is a tool that calculates the net pay an employee will receive after deducting applicable taxes and other withholdings from their gross pay.

How to Use the CRA Payroll Deductions Calculator Blog Avalon Accounting, For example, if an employee earns $1,500 per week, the. Payroll deductions online calculator (pdoc) for your 2025 payroll deductions, we strongly recommend using our pdoc.

How to Calculate Payroll Taxes Workful, Calculate payroll deductions and contributions. However, the 6.2% that you pay only applies to income up to the social security tax cap, which for 2025 is $160,200 ($168,600 for 2025).

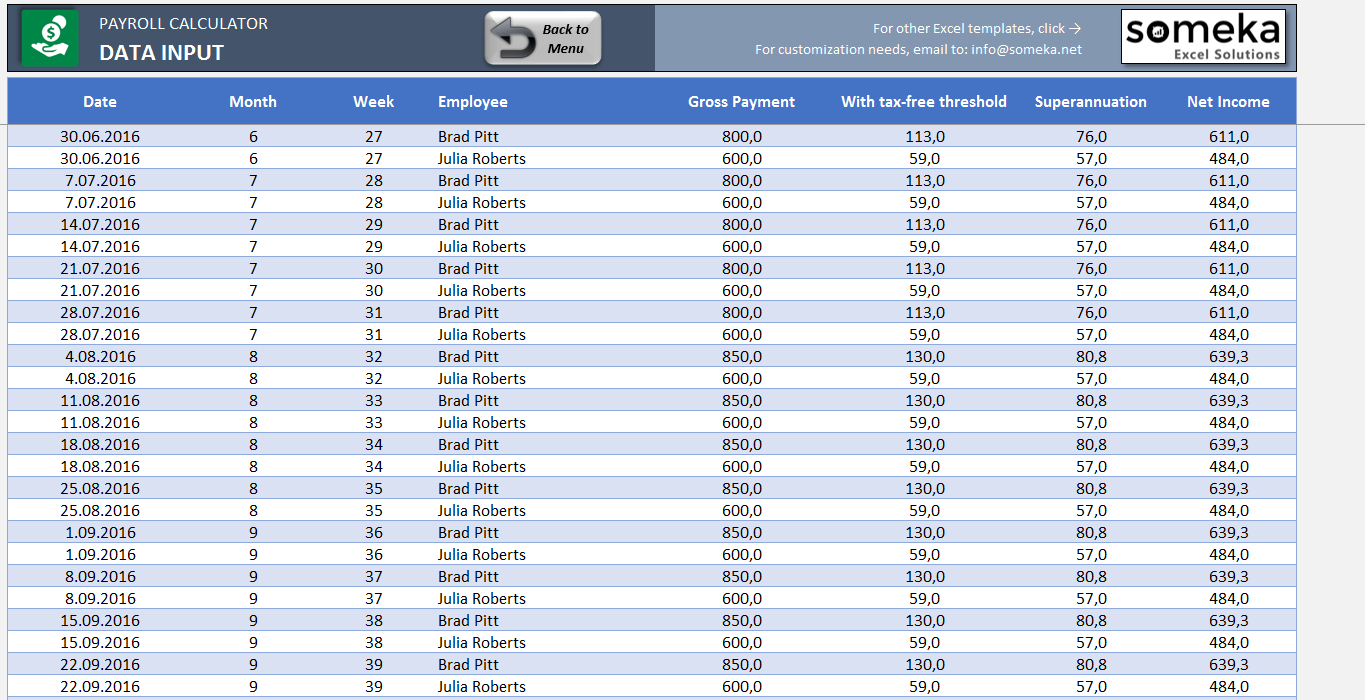

Payroll Template Excel Get Free Excel Template, Paycheck manager's free payroll calculator offers online payroll tax deduction calculation, federal income tax withheld, pay stubs, and more. For example, if an employee earns $1,500 per week, the.

2025 Biweekly Pay Calendar 2025 Calendar Printable, You can enter your current. Learn about cpp contributions, ei premiums and income tax deductions, how to calculate the deductions on the amounts.

How to Calculate Federal Tax, 2025 federal/state income tax, fica, state payroll tax, federal/state standard deduction,. 2025 federal/state income tax, fica, state payroll tax, federal/state standard deduction,.

Free Payroll Calculator Spreadsheet —, Use roll's annual income calculator to calculate an employee's yearly income after federal, state, and local taxes are deducted. Move from desktop to cloud.

How to calculate payroll deductions for employee (simple scenario) by Sunray Liao, CPA, CA, How to calculate an hourly paycheck. The salary calculator has been updated with the latest tax rates which take effect from april 2025.

Payroll deductions online calculator (pdoc) for your 2025 payroll deductions, we strongly recommend using our pdoc.